Will capacity return to trucking?

If the COVID-19 pandemic has taught us anything, it is not to rely too heavily on the patterns and connections that helped us understand the world around us prior to the outbreak. While some connections remain intact – like tighter capacity leads to higher rates – there are many whose relationships have become disconnected. Key ones include some of the macroeconomic measures and the trucking industry. The big question moving forward for surface transportation is “will capacity return as it did in 2018 after an extended period with an overheated spot market?”

To figure this out we need to look at the relationship between capacity and truck orders. Acknowledging these are not the only two measures we can observe, these are some of the purer variables when observing the freight market.

Tender rejection rates, or the rate at which a carrier rejects electronic requests for capacity, are highly correlated with increased spot market rates and activity. When rejection rates increase, spot rates do as well. When spot rates increase, carrier revenues increase as well as profit margins and cash flow. When carriers get the cash they tend to invest in expanding their fleets because that is how they grow.

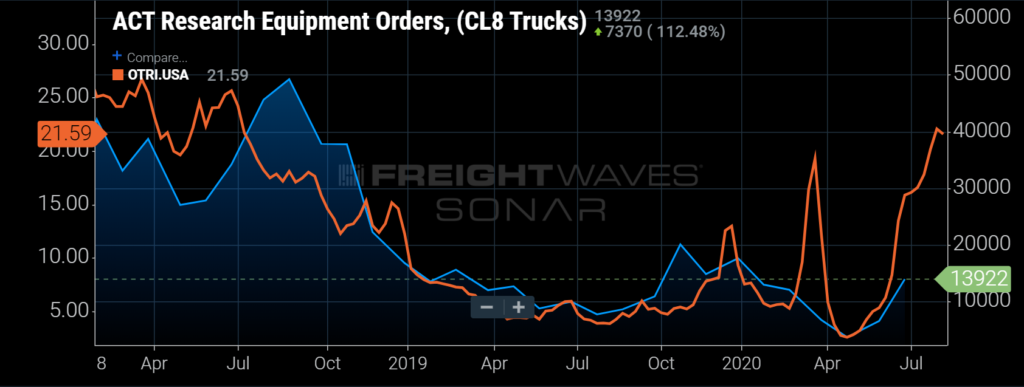

Looking at the chart of national tender rejections and Class 8 truck orders, there is a strong connection between extended periods of elevated tender rejection rates and truck orders. In 2018, rejection rates hovered above 19% through the first half of the year as new truck orders reported by ACT Research averaged 110% higher year-over-year (y/y) from April through October.

New truck orders take six to nine months on average to complete, which means carriers are making a long-term bet on the need for this equipment. In other words, they cannot expect to put the truck out on the road right away in the current environment. Once they order the truck they need to make plans to seat it with a driver as well.

It is true that many of the new truck orders are not meant to expand a fleet, but replace older units. The difference in 2018 was the sheer volume of new orders over that of a typical year was well beyond a normal range of fleet replenishment.

At the present time, there has been a long trend of rejection rates above 15% emerging over the past two months. Class 8 orders were roughly 38% higher in June y/y, which is nowhere near the expansion of 2018, but the increase does indicate carriers have a more positive outlook than they had a year earlier. In difficult times carriers will let their fleets age instead of replacing them.

There are a lot of differences between the expansion of orders in 2018 and today. There was more optimism over the sustainability of the elevated rates and restriction of capacity that electronic logging devices were supposed to bring. Little certainty exists over just about anything in 2020.

There is no doubt that some investment is being made in equipment already. However, the true measure of capacity will be if drivers who left the space will return to seat those trucks, or if more will enter. Driving schools were shuttered in the early phase of the outbreak, which will delay many new entrants in some of the larger fleets. But as some of the stimulus benefits run out there are certainly those that will find their way back into work as it becomes necessary. The current environment will entice the self-employed owner-operator to re-enter as well, but just how many will depend on the length of the current rate boom.

Read more: FreightWaves